Quick Comparison

| Feature | Home Inspection | Appraisal |

|---|---|---|

| Purpose | Evaluate physical condition | Determine market value |

| Who orders it | Buyer (usually) | Lender |

| Who pays | Buyer ($300-600) | Buyer ($400-700) |

| Who benefits | Buyer | Lender primarily |

| Required? | Optional but recommended | Required for most loans |

| Time on site | 2-4 hours | 30-60 minutes |

| Report length | 30-60+ pages | 10-20 pages |

| Focus | Systems, structure, safety | Comparable sales, features |

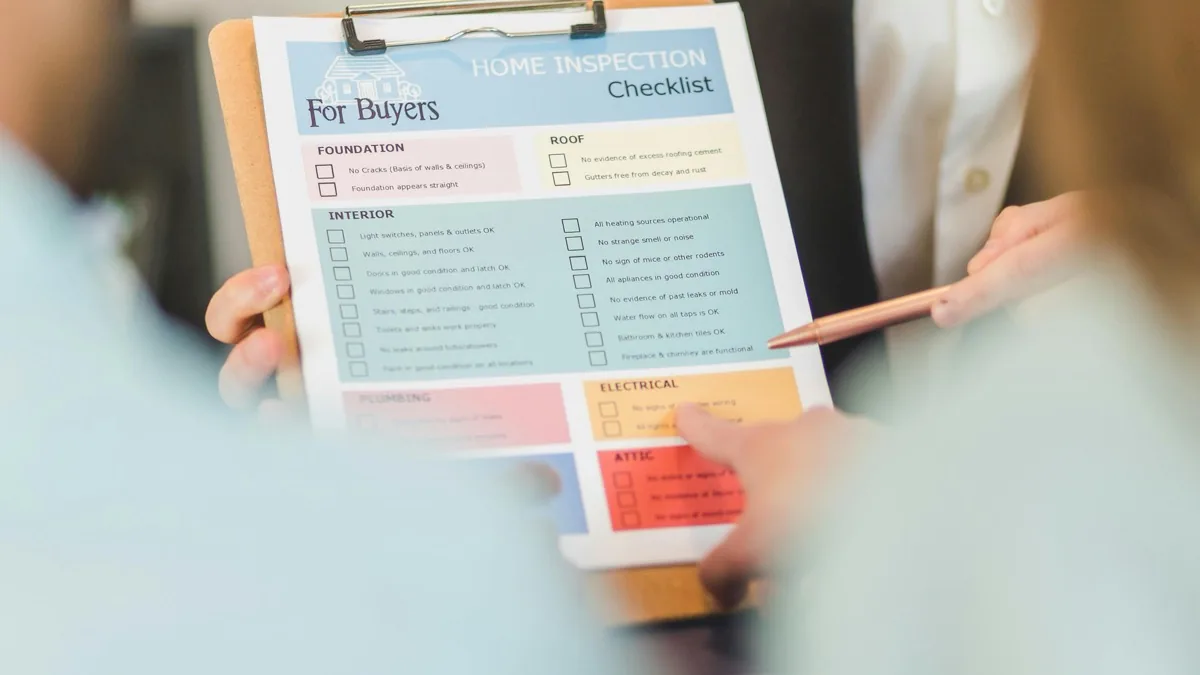

What a Home Inspection Covers

A home inspection is a thorough evaluation of the property's physical condition. The inspector examines structure, systems, and components to identify defects, safety concerns, and maintenance needs.

Systems and Components

Inspectors evaluate the roof, foundation, electrical system, plumbing, HVAC, water heater, insulation, and ventilation. They test outlets, run water, check heating and cooling, and look for signs of problems.

The inspector crawls into accessible attics and crawlspaces. They open electrical panels. They run every faucet and flush every toilet. The goal is understanding how the house works and what needs attention.

Condition Assessment

Each finding gets rated: satisfactory, monitor, repair, or safety concern. The report tells you what's working, what's wearing out, and what needs immediate action.

A home inspection doesn't estimate value. A house with a failing roof might be worth $400,000 or $200,000. The inspection doesn't care. It just tells you the roof is failing.

Who It's For

The inspection serves the buyer. You hire the inspector. You receive the report. You use it to understand what you're buying and potentially negotiate repairs or price adjustments.

Lenders don't typically see inspection reports. The inspection is your due diligence, not a loan requirement.

What an Appraisal Covers

An appraisal is a professional opinion of the property's market value. The appraiser determines what the house is worth based on comparable sales, features, and market conditions.

Comparable Sales Analysis

The appraiser researches recent sales of similar homes in the area. A 3-bedroom, 2-bath house on a quarter acre gets compared to other 3-bedroom, 2-bath houses on similar lots that sold recently.

Adjustments account for differences: an extra bathroom, a newer roof, a finished basement. The result is an estimated market value based on what similar homes actually sold for.

Property Features

Appraisers note square footage, room count, lot size, and features like fireplaces, garages, and pools. They assess the neighborhood, location, and any factors affecting marketability.

Condition matters to appraisers, but differently than to inspectors. An appraiser notes whether the house is in "good," "average," or "fair" condition. They don't evaluate whether the electrical panel is properly wired.

Who It's For

The appraisal serves the lender. If you're getting a mortgage, the lender wants to know the house is worth at least what you're paying. They're protecting their investment.

You pay for the appraisal, but the lender orders it and receives it first. You typically get a copy, but the report exists to satisfy the lender's requirements.

Why Both Matter

A house can appraise at $350,000 and still need $25,000 in repairs. These aren't contradictory findings. They're measuring different things.

The appraisal says: "Based on comparable sales, this house is worth $350,000 in its current condition."

The inspection says: "The roof needs replacement ($12,000), the HVAC is failing ($8,000), and the electrical panel needs updating ($5,000)."

Both statements can be true simultaneously. The market values the house at $350,000. The house also has problems. Buyers need both pieces of information.

When Appraisals Miss Problems

Appraisers aren't home inspectors. They don't test systems. They don't evaluate wiring. They don't climb on roofs or crawl under houses.

An appraiser might note "roof appears aged" and adjust value slightly. An inspector will tell you the roof has 2-3 years left and identify specific areas of concern.

I've seen houses appraise at full contract price while having significant issues the appraisal never mentioned. The appraisal wasn't wrong. It just wasn't designed to find those things.

When Inspections Don't Affect Value

Inspection findings don't automatically change what a house is worth. A $400,000 house with a $5,000 electrical issue is still worth close to $400,000 in most markets.

The inspection gives you negotiating information, but the market determines value. If comparable houses sell for $400,000, yours is probably worth $400,000 even with some needed repairs.

Cost Comparison

Both reports cost money, and both come out of the buyer's pocket.

Inspection Costs

Standard home inspections typically run $300-600 depending on location, home size, and inspector experience. Larger homes, older homes, and homes with additional structures cost more.

Add-on inspections like sewer scopes ($125-250), radon testing ($150-200), or mold testing ($300-500) are separate fees.

Appraisal Costs

Appraisals typically cost $400-700. The exact amount depends on property type, location, and complexity. You usually pay this fee upfront or it's rolled into closing costs.

Unlike inspections, you can't shop for appraisers. The lender selects the appraiser to ensure independence and prevent inflated valuations.

When Each Happens

Both happen after your offer is accepted but before closing. The timing is usually:

Inspection: Within 7-10 days of accepted offer. You schedule this yourself (or your agent helps). The inspection contingency in your contract sets the deadline.

Appraisal: Within 2-3 weeks of accepted offer. The lender orders this once your loan application is underway. You don't control the timing.

You'll typically have inspection results before appraisal results. This matters because inspection findings can inform your negotiations, which might affect the contract price, which might affect whether the appraisal comes in at value.

The Bottom Line

Get both. Skip neither.

The inspection tells you what's actually wrong with the house. Without it, you're buying blind. Even new construction benefits from inspection.

The appraisal protects the lender and, indirectly, protects you from overpaying. If the house won't appraise at contract price, that's information worth having.

They're different tools for different purposes. Both are part of buying a house intelligently.